SPX down, commodities time for a rebound?

AGNC 0.00%↑ I closed my long positions at $9.90 after my stop-loss was triggered. Currently, the price action indicates a bearish trend, characterized by a descending channel where lower lows and lower highs are being formed. This shift follows a rejection at a significant horizontal resistance level, reinforcing the downward momentum.

Additionally, there are indications of a potential bearish flag pattern developing, which could signal further downside movement if confirmed.

SILVER

Silver is currently at the 50% Fibonacci retracement level of its recent upward movement. This area coincides with the upper boundary of the Kumo cloud, which acts as a support level. On the 4-hour chart, oscillators are showing oversold conditions and are signaling potential bullish divergence. This suggests that this support level is significant in the near term, making a bounce higher a likely scenario.

CYBN 0.00%↑ Earlier this week, the price formed a higher high, but the RSI did not confirm this move, indicating a bearish divergence. On a more positive note, CYBN's stock price has broken out of its long-term bearish channel and is now trading above the Ichimoku cloud, maintaining support at this level.

We love Uranium miners

CCJ 0.00%↑ has been trading within an upward-sloping channel since September. Following a peak at $58.72, the price has entered a corrective phase. Despite this pullback, the price remains above the Ichimoku cloud, suggesting continued support, while the RSI has returned to 57. The recent low at $50.16 may mark the end of this correction. Given these technical indicators, I maintain an optimistic outlook for CCJ’s long-term performance.

NXE 0.00%↑ The same analysis applies to this company. Its share price remains within a bullish channel and above the Ichimoku cloud support. As long as the price holds above the recent low of $6.96, the likelihood of a new uptrend emerging increases. The target remains new highs and the upper boundary of the channel. I remain optimistic about its future performance and continue to hold a long position.

UEC 0.00%↑ has so far retraced 38% of the entire upward move from $4.06 to $8.67. Price is above the Ichimoku cloud, but I believe the correction is not over for UEC. We might see a new lower low towards the 50% or 61.8% Fibonacci retracement levels. I continue to hold onto my long position in this company as well, as I believe it has a lot of upside potential.

Gold

Gold prices are currently testing key support levels, including the channel and cloud support around $2,600. In the short term, oscillators have reached oversold conditions, signaling bullish divergence. While this suggests a potential weakening of the downtrend, it is important to note that this is not yet a reversal signal, but rather an indication that downward momentum may be losing strength.

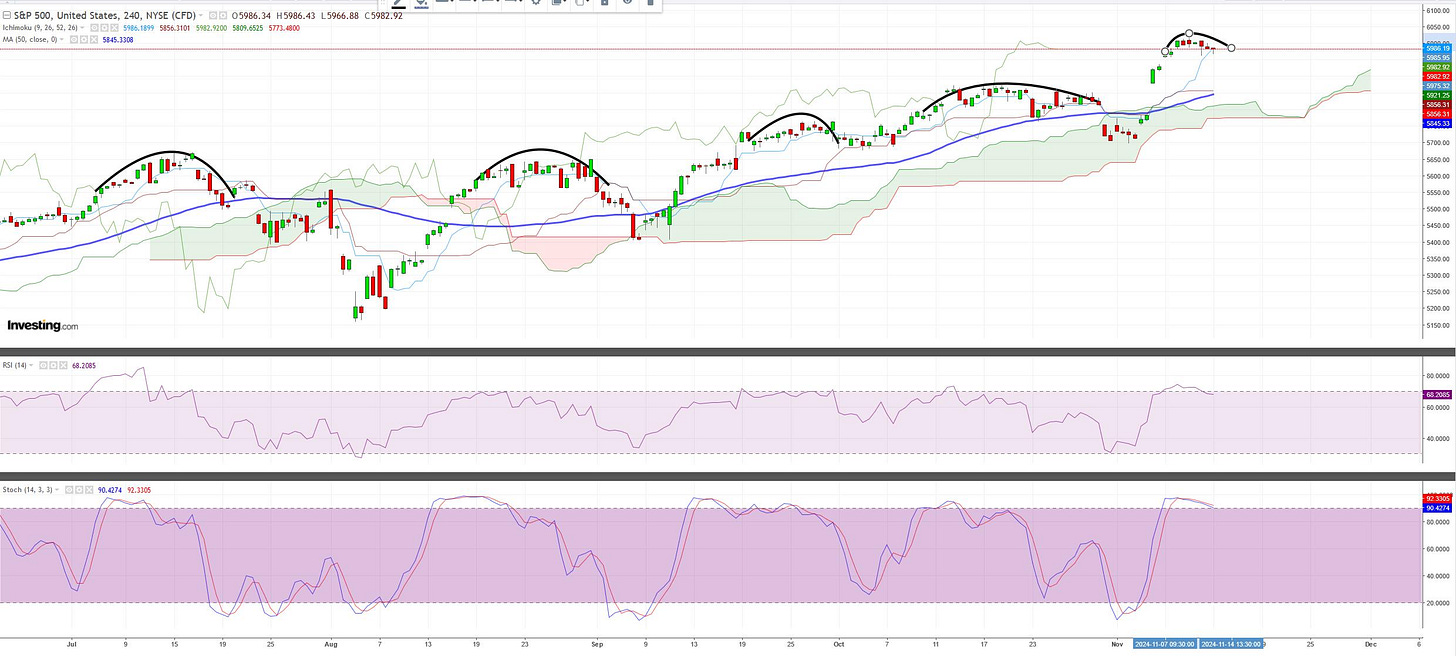

SPX As I pointed out in a previous post, I’m short-term bearish SPX and that is why I opened a short position above 6,000 level (spot price). A pull back towards cloud support and the MA (50period) around 5,850-5,800 is our short-term expectation. I do not see a major reversal in play or the end of the bull market as some gurus are forecasting for the nth time…

Ideal for my short position will be the challenge of the lower channel boundary and the tenkan-sen- kijun-sen indicators at 5,850. This is a counter trend trade and highly risky one. Before you open a position be sure to understand the possible risks and always use a stop. My stop for my short position is at 6,100 (a bit less than 100 points) and of course it will be adjusted to my break even if price breaks below 5,950.